Correctly Classifying Import and Export Goods

Understanding Customs Classification of Imported & Exported Goods

Classifying Imported and Exported Goods Correctly

An essential and necessary part of successful importing and exporting is the correct classification of your products for customs clearance in accordance with the harmonised system used worldwide. The customs classification provides details of what the products are, what they are made of, how they are used and how they are packaged. In addition, the customs classification determines:

- Customs duties and taxes

- Import and export controls and limitations

- Documentation requirements

- Import or export licencing obligations

- Applicable preferential duty rates

- Security measures

- Commercial policy measures

Incorrectly Classifying Goods with Customs

Classifying your goods correctly for import or export can be complicated and companies will require a good understanding of international trade regulations to get it right. The use of incorrect customs classifications can result in audits by customs authorities, customs clearance delays, seizure of the goods and / or sizeable financial penalties. You may also pay incorrect duties and taxes resulting in additional charges and fees.

Certain products can be liable to import or export controls and licencing, therefore making an incorrect customs classification will be seen as breaking the law. It is your responsibility to get your classification and licencing right, even if you use an agent or freight forwarder.

How to Classify your Goods

The World Customs Organization (WCO) developed the Harmonized Commodity Description and Coding System, known as the "Harmonized System" or "HS". The WCO have classified more than 5,000 commodity groups at a 6-digit code level. Over 200 countries use the uniform 6-digit classification, as a basis for their own Customs tariffs and trade statistics records.

There are Commodity Description Codes for over 98% of products, classifying products from a pin to an elephant. These codes assist in identifying what the product is for customs clearance purposes, so that correct duties and taxes can be charged, preferential trade agreements can be applied, and import or export restrictions can be identified.

What are Commodity Description Codes?

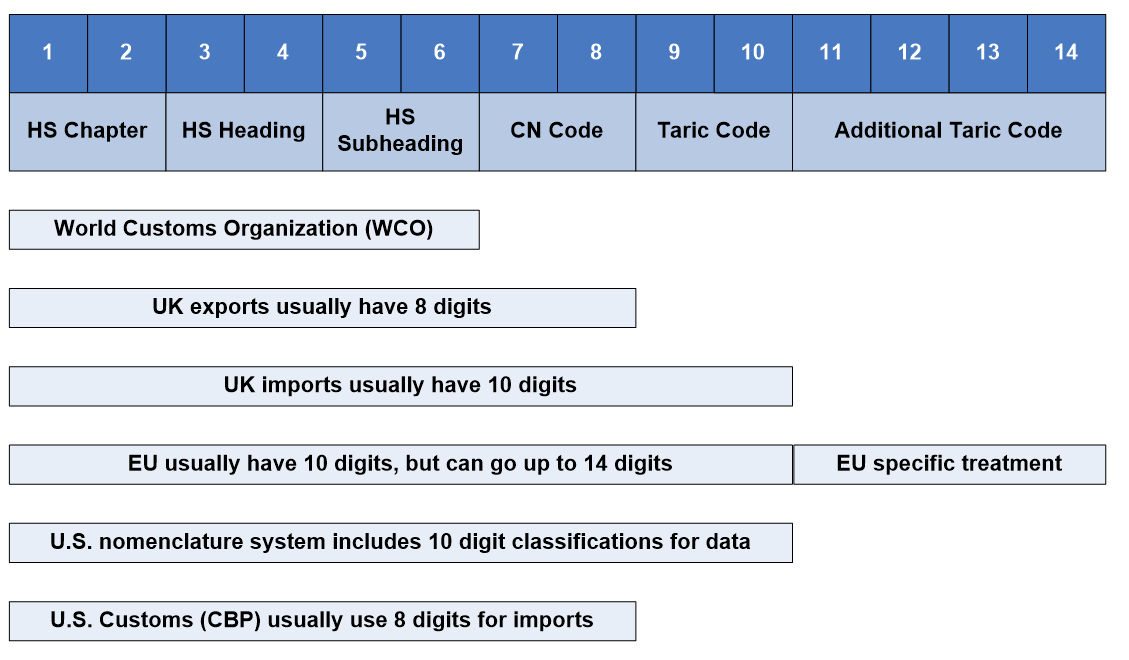

When moving your products between different countries you must classify them correctly using the Harmonized System. Conversely, most countries require products to be classified at a more elevated level than the 6-digit Harmonized System and the codes can go up to a 14-digit level to allow for tariff policies.

Different countries tend to use alternative terms to describe these extended codes and some of these terms have become interchangeable within international trade. Your company should follow the requirements of the country they are importing or exporting too.

Examples:

HS Code

The HS Code is the World Customs Organization (WCO) Harmonized System code, which is the universal first 6-digits of most classifications.

Harmonized Tariff Schedule Code (HTS)

The Harmonized Tariff Schedule Code (HTS) is a 7 to 10-digit code, which is more specific to importing into the United States.

USHTS or HTSUS

USHTS or HTSUS is the Harmonized Tariff Schedule of the United States, which is generally 10-digits in length.

Commodity Codes, Trade Tariff Commodity Codes and Tariff Codes

Commodity Codes (sometimes referred to as Trade Tariff Commodity Codes or Tariff Codes) are used within the United Kingdom and are generally 8 to 10-digits in length.

Commodity Codes

Commodity Codes are used within the European Union (EU) and include additional Combined Nomenclature (CN) and Integrated Tariff (TARIC) digits. Most EU commodity codes have 10-digits, but certain goods are classified using 14-digits. Additional 4-digit codes are used mainly when the goods nomenclature needs to be further detailed for specific EU purposes.

Structure of Tariff / Commodity Codes

Schedule B Numbers

The USA use Schedule B numbers for the classification of their domestic and foreign export commodities. Schedule B numbers are based on HS codes but contain additional 10-digit subdivisions to gather export data of particular U.S. interest. Schedule B numbers are administered by the U.S. Census Bureau.

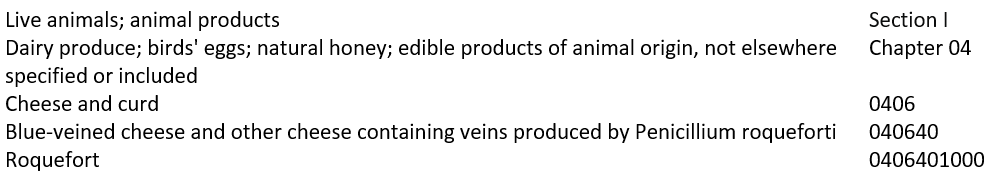

Example: Customs Classification of Cheese

Roquefort Cheese would be classified for export from the European Union using the EU commodity code. The commercial invoice for the Roquefort Cheese exported from the EU to the UK would show an 8-digit commodity code from the EU TARIC, while the UK importer would use a 10-digit commodity code from the UK TARIFF.

Source: HM Revenue & Customs

In the UK the first 8-digits of the commodity code are used for the declared imports or exports and generally determine the rate of Customs Duty applicable. The 9 and 10 digit of the commodity code provides additional detail in relation to the goods being declared. Although most UK Customs Duty rates are set with the first 8-digits they can affect the duty due and measures applied to the goods.

Are Customs Classifications subject to change?

Updates are periodically made by customs authorities and these may impact the validity of the customs classification codes used for your products. In addition, changes to legislation can result in incorrect classification of your goods. The Harmonized System (HS) is also updated every 5 years by the World Customs Organisation. Therefore, it is important to keep up to date with these changes.

Latest Edition of the Harmonized System (HS)

On 1 January 2022, the World Customs Organization (WCO) published the latest edition of the Harmonized System. The WTO stated:

HS 2022, which is the seventh edition of the Harmonized System (HS) nomenclature used for the uniform classification of goods traded internationally all over the world, has been accepted by all Contracting Parties to the Harmonized System Convention. It shall come into force on 1 January 2022.

The HS serves as the basis for Customs tariffs and for the compilation of international trade statistics in 211 economies (of which 158 are Contracting Parties to the HS Convention). The new HS2022 edition makes some major changes to the Harmonized System with a total of 351 sets of amendments covering a wide range of goods moving across borders.

Classification Questions and Support

The processes and procedures for correctly classifying your goods can be complicated. If you require any assistance or have any questions regarding classifying your goods for import or export, please call +44 (0) 118 932 8447 or email info@icsglobalservices.co.uk

Ian Simmonds

ICS Global Services Limited