Successfully ImplementedProjects

Brexit & Post-Brexit

Overview. Developed contingency plans to ensure that customers’ products were delivered correctly after 1 January 2021. Significant changes have occurred after the UK left the EU. All UK businesses are required to provide Customs documentation for products exported to, or imported from the EU, even with the new ‘EU Deal’ on Brexit.

Authorised Economic Operator (AEO). Worked with a UK importer to identify the benefits of AEO after Brexit and highlighted that AEO accredited companies will have their goods cleared through Customs' controls quicker than goods for non-AEO accredited companies. AEO would also give them easier access to customs procedures such as Inward/Outward Processing Relief.

We provide consultancy services to assist you with achieving AEO status.

Documentation. As part of our customer services, we have provided the necessary Customs documentation to comply with the new regulations.

Customs Declarations. As specialists, we have assisted our clients with their Customs Declarations and Safety and Security Declarations. HMRC do not recommend that businesses attempt to complete customs declarations themselves unless they have the specialist skills. This process is very time consuming, and businesses should not underestimate how much time and effort it will take.

Supply Chain. We have developed new supply chain solutions to support our clients’ shipments into and out of the EU. This involved the management of both physical and information flows relating to a wide assortment of products, tracking them from the point of their origin and until they reach the end customer destination. Read more....

Warehousing

Bonded Logistics Park solution within China. A Customer manufacturing within a Bonded Logistics Park in Shanghai required imported components readily available within China. Contracted a 3PL warehouse solution within the same Bonded Logistics Park as the customer’s factories. Implemented processes to receive vendor deliveries from 5 countries in compliance with China Customs. Improved stock availability for the customers, maintained QA/QC standards, reduced delays to the manufacturing process and costs were offset by not paying any duties or taxes within China.

Read more about this warehouse solution >>

Consolidation Warehouse. UK e-commerce retailer required a location to consolidated shipments to meet customer demand and to reduce pressure on their UK warehouses. The solution was to implement a bonded warehouse solution in Shenzhen, China. The warehouse services covered receiving consignments from various suppliers, storage, product labelling, pre-retail processing services, pick and pack to meet demand, packaging, sea container fill and export formalities.

Low Cost Country Sourcing

Customs and Tax

International Shipping

Sea-Air Freight. UK fashion clothing company found shipping products from Asia by sea took too long and shipping the same products by air was too expensive. The solution was to combined benefits of Sea-Air traffic and obtain the right balance between cost and time. The solution involved shipping Cargo from Asia to Dubai by sea and then by air from Dubai to London.

End-to-end Management. A UK company’s international supply chains had become complex and fragmented. Following a review of the end-to-end supply chains, we developed and implemented solutions to centralise the global supply chain, leverage volumes and reduce costs, whilst ensuring full international trade compliance.

Supply Chain Design. Developed and executed a complex global supply chain strategy to support all purchasing activities arising from low-cost counties via 450 international routes, and improved margins.

Intermodal

Distribution

Software Solutions

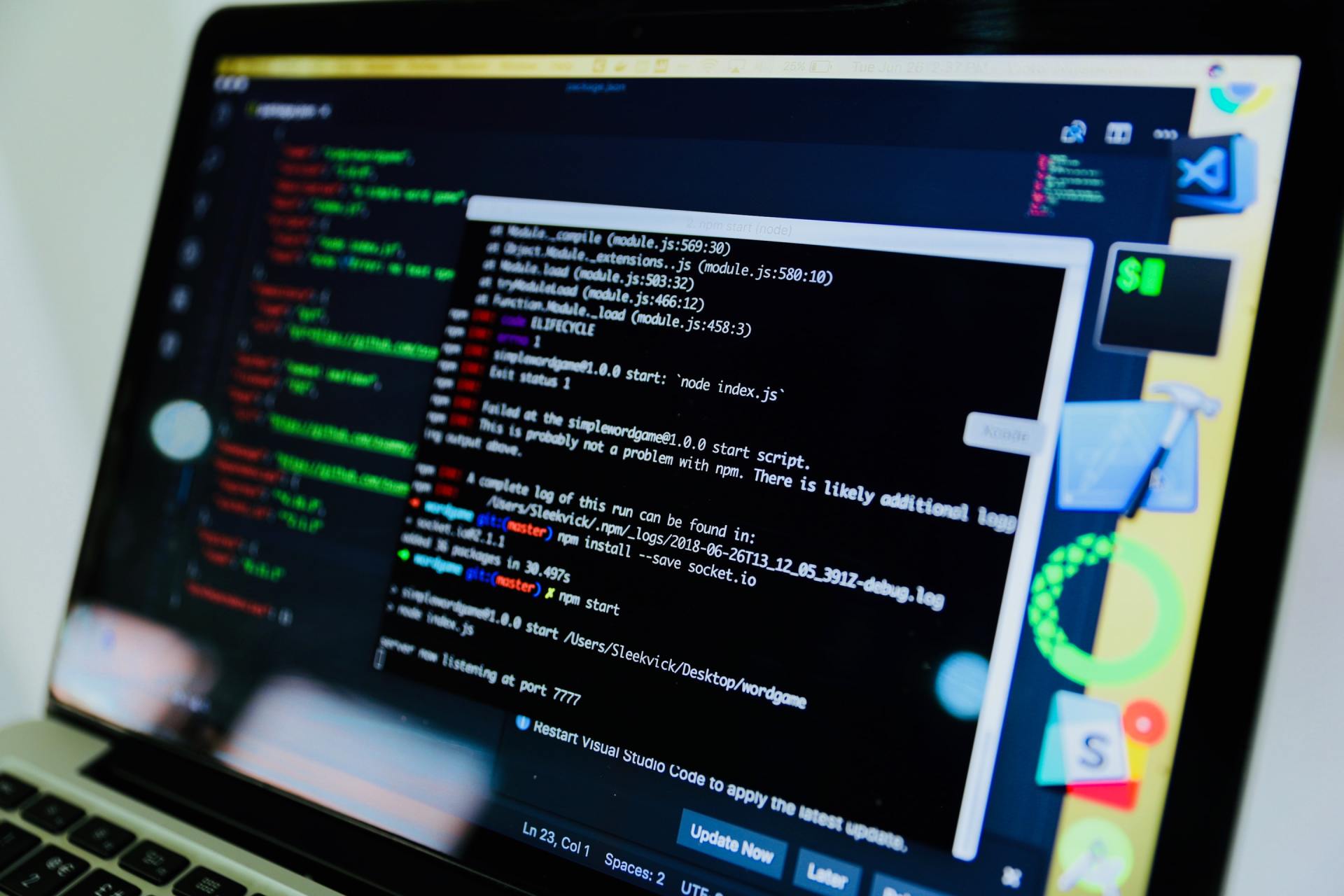

Software Solutions. Scoped and implemented software solutions to manage products through the end-to-end supply chain, with software providers such as SAP, GT Nexus, Amber Road, TradeCard and Integration Point.